Casino Money Laundering Red Flags

- Casino Money Laundering Red Flags Pictures

- Anti Money Laundering Red Flags

- Fincen Money Laundering Red Flags

- Money Laundering Through Casinos

- Casino Money Laundering Red Flags In America

Finding your favourites will be an exciting, fun-filled journey of exploration. If you’re looking Casino Money Laundering Red Flags for somewhere to start, you might want to check some of our most popular Online Slots games in the Wheel of Fortune family of games: Wheel of Fortune Triple Extreme Spin; Wheel of Fortune Ultra 5 Reels. Crown's former executive chairman John Alexander says he was unaware of red flags in the company's casino operations pointing towards suspected large-scale money laundering, despite Crown attempting to dismiss the allegations last year. Crown Resorts chairwoman Helen Coonan has admitted the casino giant missed red flags of possible money laundering involving VIP high rollers. Ms Coonan, a former federal Liberal senator, faced a. The conviction in August of two former Bank of China managers and their wives in Las Vegas for money laundering and other crimes illustrates the continuing vulnerability of casinos to money laundering. Xu Chaofan, et al. (2:02-CR-0674-PMP (LRL)). Over the course of several years, the defendants facilitated the theft of $482 million from. 4 Red Flags of Money Laundering or Terrorist Financing by Lowers & Associates May 26, 2015 One of the most important aspects of BSA/AML compliance is the responsibility it places on regulated financial entities to report suspicious transactions.

Appendices

APPENDIX F: MONEY LAUNDERING AND TERRORIST FINANCING 'RED FLAGS'

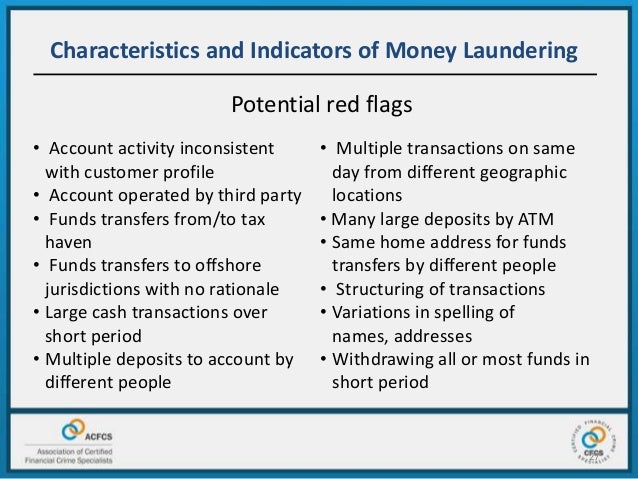

The following are examples of potentially suspicious activities, or 'red flags' for both money laundering and terrorist financing. Although these lists are not all-inclusive, they may help banks and examiners recognize possible money laundering and terrorist financing schemes. FinCEN issues advisories containing examples of 'red flags' to inform and assist banks in reporting instances of suspected money laundering, terrorist financing, and fraud. In order to assist law enforcement in its efforts to target these activities, FinCEN requests that banks check the appropriate box(es) in the Suspicious Activity Information section and include certain key terms in the narrative section of the SAR. The advisories and guidance can be found on FinCEN's website. 302 Management’s primary focus should be on reporting suspicious activities, rather than on determining whether the transactions are in fact linked to money laundering, terrorist financing, or a particular crime.

The following examples are red flags that, when encountered, may warrant additional scrutiny. The mere presence of a red flag is not by itself evidence of criminal activity. Closer scrutiny should help to determine whether the activity is suspicious or one for which there does not appear to be a reasonable business or legal purpose.

Potentially Suspicious Activity That May Indicate Money Laundering

Customers Who Provide Insufficient or Suspicious Information

- A customer uses unusual or suspicious identification documents that cannot be readily verified.

- A customer provides an individual taxpayer identification number after having previously used a Social Security number.

- A customer uses different taxpayer identification numbers with variations of his or her name.

- A business is reluctant, when establishing a new account, to provide complete information about the nature and purpose of its business, anticipated account activity, prior banking relationships, the names of its officers and directors, or information on its business location.

- A customer’s home or business telephone is disconnected.

- The customer’s background differs from that which would be expected on the basis of his or her business activities.

- A customer makes frequent or large transactions and has no record of past or present employment experience.

- A customer is a trust, shell company, or Private Investment Company that is reluctant to provide information on controlling parties and underlying beneficiaries. Beneficial owners may hire nominee incorporation services to establish shell companies and open bank accounts for those shell companies while shielding the owner’s identity.

Efforts to Avoid Reporting or Recordkeeping Requirement

- A customer or group tries to persuade a bank employee not to file required reports or maintain required records.

- A customer is reluctant to provide information needed to file a mandatory report, to have the report filed, or to proceed with a transaction after being informed that the report must be filed.

- A customer is reluctant to furnish identification when purchasing negotiable instruments in recordable amounts.

- A business or customer asks to be exempted from reporting or recordkeeping requirements.

- A person customarily uses the automated teller machine to make several bank deposits below a specified threshold.

- A customer deposits funds into several accounts, usually in amounts of less than $3,000, which are subsequently consolidated into a master account and transferred outside of the country, particularly to or through a location of specific concern (e.g., countries designated by national authorities and Financial Action Task Force on Money Laundering (FATF) as noncooperative countries and territories).

- A customer accesses a safe deposit box after completing a transaction involving a large withdrawal of currency, or accesses a safe deposit box before making currency deposits structured at or just under $10,000, to evade CTR filing requirements.

Funds Transfers

- Many funds transfers are sent in large, round dollar, hundred dollar, or thousand dollar amounts.

- Funds transfer activity occurs to or from a financial secrecy haven, or to or from a higher-risk geographic location without an apparent business reason or when the activity is inconsistent with the customer’s business or history.

- Funds transfer activity occurs to or from a financial institution located in a higher risk jurisdiction distant from the customer's operations.

- Many small, incoming transfers of funds are received, or deposits are made using checks and money orders. Almost immediately, all or most of the transfers or deposits are wired to another city or country in a manner inconsistent with the customer’s business or history.

- Large, incoming funds transfers are received on behalf of a foreign client, with little or no explicit reason.

- Funds transfer activity is unexplained, repetitive, or shows unusual patterns.

- Payments or receipts with no apparent links to legitimate contracts, goods, or services are received.

- Funds transfers are sent or received from the same person to or from different accounts.

- Funds transfers contain limited content and lack related party information.

Automated Clearing House Transactions

- Large-value, automated clearing house (ACH) transactions are frequently initiated through third-party service providers (TPSP) by originators that are not bank customers and for which the bank has no or insufficient due diligence.

- TPSPs have a history of violating ACH network rules or generating illegal transactions, or processing manipulated or fraudulent transactions on behalf of their customers.

- Multiple layers of TPSPs that appear to be unnecessarily involved in transactions.

- Unusually high level of transactions initiated over the Internet or by telephone.

- NACHA — The Electronic Payments Association (NACHA) information requests indicate potential concerns with the bank's usage of the ACH system.

Activity Inconsistent with the Customer’s Business

- The currency transaction patterns of a business show a sudden change inconsistent with normal activities.

- A large volume of cashier’s checks, money orders, or funds transfers is deposited into, or purchased through, an account when the nature of the accountholder’s business would not appear to justify such activity.

- A retail business has dramatically different patterns of currency deposits from similar businesses in the same general location.

- Unusual transfers of funds occur among related accounts or among accounts that involve the same or related principals.

- The owner of both a retail business and a check-cashing service does not ask for currency when depositing checks, possibly indicating the availability of another source of currency.

- Goods or services purchased by the business do not match the customer’s stated line of business.

- Payments for goods or services are made by checks, money orders, or bank drafts not drawn from the account of the entity that made the purchase.

Lending Activity

- Loans secured by pledged assets held by third parties unrelated to the borrower.

- Loan secured by deposits or other readily marketable assets, such as securities, particularly when owned by apparently unrelated third parties.

- Borrower defaults on a cash-secured loan or any loan that is secured by assets which are readily convertible into currency.

- Loans are made for, or are paid on behalf of, a third party with no reasonable explanation.

- To secure a loan, the customer purchases a certificate of deposit using an unknown source of funds, particularly when funds are provided via currency or multiple monetary instruments.

- Loans that lack a legitimate business purpose, provide the bank with significant fees for assuming little or no risk, or tend to obscure the movement of funds (e.g., loans made to a borrower and immediately sold to an entity related to the borrower).

Changes in Bank-to-Bank Transactions

- The size and frequency of currency deposits increases rapidly with no corresponding increase in noncurrency deposits.

- A bank is unable to track the true accountholder of correspondent or concentration account transactions.

- The turnover in large-denomination bills is significant and appears uncharacteristic, given the bank’s location.

- Changes in currency-shipment patterns between correspondent banks are significant.

Cross-Border Financial Institution Transactions

- U.S. bank increases sales or exchanges of large denomination U.S. bank notes to Mexican financial institution(s).

- Large volumes of small denomination U.S. banknotes being sent from Mexican casas de cambio to their U.S. accounts via armored transport or sold directly to U.S. banks. These sales or exchanges may involve jurisdictions outside of Mexico.

- Casas de cambio direct the remittance of funds via multiple funds transfers to jurisdictions outside of Mexico that bear no apparent business relationship with the casas de cambio. Funds transfer recipients may include individuals, businesses, and other entities in free trade zones.

- Casas de cambio deposit numerous third-party items, including sequentially numbered monetary instruments, to their accounts at U.S. banks.

- Casas de cambio direct the remittance of funds transfers from their accounts at Mexican financial institutions to accounts at U.S. banks. These funds transfers follow the deposit of currency and third-party items by the casas de cambio into their Mexican financial institution.

Bulk Currency Shipments

- An increase in the sale of large denomination U.S. bank notes to foreign financial institutions by U.S. banks.

- Large volumes of small denomination U.S. bank notes being sent from foreign nonbank financial institutions to their accounts in the United States via armored transport, or sold directly to U.S. banks.

- Multiple wire transfers initiated by foreign nonbank financial institutions that direct U.S. banks to remit funds to other jurisdictions that bear no apparent business relationship with that foreign nonbank financial institution. Recipients may include individuals, businesses, and other entities in free trade zones and other locations.

- The exchange of small denomination U.S. bank notes for large denomination U.S. bank notes that may be sent to foreign countries.

- Deposits by foreign nonbank financial institutions to their accounts at U.S. banks that include third-party items, including sequentially numbered monetary instruments.

- Deposits of currency and third-party items by foreign nonbank financial institutions to their accounts at foreign financial institutions and thereafter direct wire transfers to the foreign nonbank financial institution's accounts at U.S. banks.

Trade Finance

- Items shipped that are inconsistent with the nature of the customer’s business (e.g., a steel company that starts dealing in paper products, or an information technology company that starts dealing in bulk pharmaceuticals).

- Customers conducting business in higher-risk jurisdictions.

- Customers shipping items through higher-risk jurisdictions, including transit through noncooperative countries.

- Customers involved in potentially higher-risk activities, including activities that may be subject to export/import restrictions (e.g., equipment for military or police organizations of foreign governments, weapons, ammunition, chemical mixtures, classified defense articles, sensitive technical data, nuclear materials, precious gems, or certain natural resources such as metals, ore, and crude oil).

- Obvious over- or under-pricing of goods and services.

- Obvious misrepresentation of quantity or type of goods imported or exported.

- Transaction structure appears unnecessarily complex and designed to obscure the true nature of the transaction.

- Customer requests payment of proceeds to an unrelated third party.

- Shipment locations or description of goods not consistent with letter of credit.

- Significantly amended letters of credit without reasonable justification or changes to the beneficiary or location of payment. Any changes in the names of parties should prompt additional OFAC review.

Privately Owned Automated Teller Machines

- Automated teller machine (ATM) activity levels are high in comparison with other privately owned or bank-owned ATMs in comparable geographic and demographic locations.

- Sources of currency for the ATM cannot be identified or confirmed through withdrawals from account, armored car contracts, lending arrangements, or other appropriate documentation.

Insurance

- A customer purchases products with termination features without concern for the product’s investment performance.

- A customer purchases insurance products using a single, large premium payment, particularly when payment is made through unusual methods such as currency or currency equivalents.

- A customer purchases a product that appears outside the customer’s normal range of financial wealth or estate planning needs.

- A customer borrows against the cash surrender value of permanent life insurance policies, particularly when payments are made to apparently unrelated third parties.

- Policies are purchased that allow for the transfer of beneficial ownership interests without the knowledge and consent of the insurance issuer. This would include secondhand endowment and bearer insurance policies.

- A customer is known to purchase several insurance products and uses the proceeds from an early policy surrender to purchase other financial assets.

- A customer uses multiple currency equivalents (e.g., cashier's checks and money orders) from different banks and money services businesses to make insurance policy or annuity payments.

Shell Company Activity

- A bank is unable to obtain sufficient information or information is unavailable to positively identify originators or beneficiaries of accounts or other banking activity (using Internet, commercial database searches, or direct inquiries to a respondent bank).

- Payments to or from the company have no stated purpose, do not reference goods or services, or identify only a contract or invoice number.

- Goods or services, if identified, do not match profile of company provided by respondent bank or character of the financial activity; a company references remarkably dissimilar goods and services in related funds transfers; explanation given by foreign respondent bank is inconsistent with observed funds transfer activity.

- Transacting businesses share the same address, provide only a registered agent’s address, or have other address inconsistencies.

- Unusually large number and variety of beneficiaries are receiving funds transfers from one company.

- Frequent involvement of multiple jurisdictions or beneficiaries located in higher-risk offshore financial centers.

- A foreign correspondent bank exceeds the expected volume in its client profile for funds transfers, or an individual company exhibits a high volume and pattern of funds transfers that is inconsistent with its normal business activity.

- Multiple high-value payments or transfers between shell companies with no apparent legitimate business purpose.

- Purpose of the shell company is unknown or unclear.

Embassy, Foreign Consulate, and Foreign Mission Accounts

- Official embassy business is conducted through personal accounts.

- Account activity is not consistent with the purpose of the account, such as pouch activity or payable upon proper identification transactions.

- Accounts are funded through substantial currency transactions.

- Accounts directly fund personal expenses of foreign nationals without appropriate controls, including, but not limited to, expenses for college students.

Employees

- Employee exhibits a lavish lifestyle that cannot be supported by his or her salary.

- Employee fails to conform to recognized policies, procedures, and processes, particularly in private banking.

- Employee is reluctant to take a vacation.

- Employee overrides a hold placed on an account identified as suspicious so that transactions can occur in the account.

Other Unusual or Suspicious Customer Activity

Casino Money Laundering Red Flags Pictures

- Customer frequently exchanges small-dollar denominations for large-dollar denominations.

- Customer frequently deposits currency wrapped in currency straps or currency wrapped in rubber bands that is disorganized and does not balance when counted.

- Customer purchases a number of cashier’s checks, money orders, or traveler’s checks for large amounts under a specified threshold.

- Customer purchases a number of open-end prepaid cards for large amounts. Purchases of prepaid cards are not commensurate with normal business activities.

- Customer receives large and frequent deposits from online payments systems yet has no apparent online or auction business.

- Monetary instruments deposited by mail are numbered sequentially or have unusual symbols or stamps on them.

- Suspicious movements of funds occur from one bank to another, and then funds are moved back to the first bank.

- Deposits are structured through multiple branches of the same bank or by groups of people who enter a single branch at the same time.

- Currency is deposited or withdrawn in amounts just below identification or reporting thresholds.

- Customer visits a safe deposit box or uses a safe custody account on an unusually frequent basis.

- Safe deposit boxes or safe custody accounts opened by individuals who do not reside or work in the institution’s service area, despite the availability of such services at an institution closer to them.

- Customer repeatedly uses a bank or branch location that is geographically distant from the customer's home or office without sufficient business purpose.

- Customer exhibits unusual traffic patterns in the safe deposit box area or unusual use of safe custody accounts. For example, several individuals arrive together, enter frequently, or carry bags or other containers that could conceal large amounts of currency, monetary instruments, or small valuable items.

- Customer rents multiple safe deposit boxes to store large amounts of currency, monetary instruments, or high-value assets awaiting conversion to currency, for placement into the banking system. Similarly, a customer establishes multiple safe custody accounts to park large amounts of securities awaiting sale and conversion into currency, monetary instruments, outgoing funds transfers, or a combination thereof, for placement into the banking system.

- Unusual use of trust funds in business transactions or other financial activity.

- Customer uses a personal account for business purposes.

- Customer has established multiple accounts in various corporate or individual names that lack sufficient business purpose for the account complexities or appear to be an effort to hide the beneficial ownership from the bank.

- Customer makes multiple and frequent currency deposits to various accounts that are purportedly unrelated.

- Customer conducts large deposits and withdrawals during a short time period after opening and then subsequently closes the account or the account becomes dormant. Conversely, an account with little activity may suddenly experience large deposit and withdrawal activity.

- Customer makes high-value transactions not commensurate with the customer's known incomes.

Potentially Suspicious Activity That May Indicate Terrorist Financing

The following examples of potentially suspicious activity that may indicate terrorist financing are primarily based on guidance 'Guidance for Financial Institutions in Detecting Terrorist Financing' provided by the FATF. 303 FATF is an intergovernmental body whose purpose is the development and promotion of policies, both at national and international levels, to combat money laundering and terrorist financing.

Activity Inconsistent With the Customer’s Business

- Funds are generated by a business owned by persons of the same origin or by a business that involves persons of the same origin from higher-risk countries (e.g., countries designated by national authorities and FATF as noncooperative countries and territories).

- The stated occupation of the customer is not commensurate with the type or level of activity.

- Persons involved in currency transactions share an address or phone number, particularly when the address is also a business location or does not seem to correspond to the stated occupation (e.g., student, unemployed, or self-employed).

- Regarding nonprofit or charitable organizations, financial transactions occur for which there appears to be no logical economic purpose or in which there appears to be no link between the stated activity of the organization and the other parties in the transaction.

- A safe deposit box opened on behalf of a commercial entity when the business activity of the customer is unknown or such activity does not appear to justify the use of a safe deposit box.

Funds Transfers

- A large number of incoming or outgoing funds transfers take place through a business account, and there appears to be no logical business or other economic purpose for the transfers, particularly when this activity involves higher-risk locations.

- Funds transfers are ordered in small amounts in an apparent effort to avoid triggering identification or reporting requirements.

- Funds transfers do not include information on the originator, or the person on whose behalf the transaction is conducted, when the inclusion of such information would be expected.

- Multiple personal and business accounts or the accounts of nonprofit organizations or charities are used to collect and funnel funds to a small number of foreign beneficiaries.

- Foreign exchange transactions are performed on behalf of a customer by a third party, followed by funds transfers to locations having no apparent business connection with the customer or to higher-risk countries.

Other Transactions That Appear Unusual or Suspicious

- Transactions involving foreign currency exchanges are followed within a short time by funds transfers to higher-risk locations.

- Multiple accounts are used to collect and funnel funds to a small number of foreign beneficiaries, both persons and businesses, particularly in higher-risk locations.

- A customer obtains a credit instrument or engages in commercial financial transactions involving the movement of funds to or from higher-risk locations when there appear to be no logical business reasons for dealing with those locations.

- Banks from higher-risk locations open accounts.

- Funds are sent or received via international transfers from or to higher-risk locations.

- Insurance policy loans or policy surrender values that are subject to a substantial surrender charge.

| < Previous Page Appendix E – International Organizations | Next Page > Appendix G – Structuring |

Australian authorities have been increasingly cracking down on money laundering and financial crime, through studying suspicious behaviour and transactions to aid in the detection and prosecution of offenders.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) provides various case studies illustrating its key role in these investigations, also highlighting the common behaviours which may indicate money laundering and financial crime.

Key red flags include frequent large cash deposits or withdrawals, large fund transfers from business to personal accounts, high volume international fund transfers, and generally suspicious transactions that involve high risk jurisdictions, the use of third-party company accounts, or that simply don’t match up with the customer profile.

The following case studies illustrate how these red flags come into play in the investigation of money laundering and financial crime.

Case study 1: International money laundering

Case Background

Anti Money Laundering Red Flags

An Australian-based Hong Kong man collected millions of dollars in cash over multiple occasions from associates, travelling from Sydney to Perth and visiting banks and ATMs with other individuals to deposit cash into a variety of accounts. A total of 163 bank transactions estimated to be worth almost $30 million were made, with up to 10 bank branches visited per day.

Investigation

Fincen Money Laundering Red Flags

Bank reporting of Threshold Transaction Reports enabled AUSTRAC to identify patterns of transactional activity consistent with money laundering.

A joint-agency task force was set up between AUSTRAC, Australian Federal Police, Australian Border Force and Western Australia Police, and AUSTRAC’s financial intelligence helped law enforcement to understand money laundering methodologies and identify suspects.

Case Result

It was identified that a Hong Kong–based money laundering syndicate was operating in Australia. Ten offenders were arrested on money laundering and drug charges, with the syndicate’s key Australia-based member sentenced to 10 years in prison.

Red Flags

- Use of third-party company accounts to complicate transaction activity

- Third parties making regular cash deposits into business accounts

- Frequent cash deposits at different branches and ATMs on the same day

- Regular or multiple cash deposits just below the A$10,000 cash transaction reporting threshold

- High-value cash deposits and transfers out of new business accounts

- High-volume account activity involving significant amounts of cash

Case study 2: Overseas investment scam defrauding Australians

Case Background

An Australian man was transferring millions of dollars overseas, including to a business in Romania.

Investigation

Suspicions were aroused by Romanian authorities, who asked AUSTRAC to investigate the man’s financial activities. AUSTRAC discovered that the elderly man had been withdrawing large sums of money from his retirement savings to make the transfers to five businesses in Hong Kong, Bulgaria and Romania.

Case Result

It was identified that the man was the victim of an ‘advance fee’ investment scam, deceived into sending payments with the promise of greater future monetary benefits. Further investigation revealed another 125 Australians who were likely to be victims.

AUSTRAC shared financial intelligence with its Fintel Alliance partners, leading them to blacklist the five overseas businesses. Intelligence was also provided to counterparts in the relevant jurisdictions to enable them to carry out criminal investigations and help Australian banks and victims to recover funds.

Red Flags

- High volume of international funds transfers from Australia for no apparent reason

- International funds transfers to a high-risk jurisdiction

Case study 3: Business owner jailed for illegal ‘phoenix’ activity

Case Background

Over a 12 year period, an Australian man operated a labour hire business through four different companies, failing to pay GST and PAYGW to the ATO.

A second company was created to continue the business of the original company, which had been deliberately liquidated to avoid paying its debts, an illegal activity known as ‘phoenixing’. This process was repeated until a fourth company was created.

To distance himself from the companies, the man appointed family members and associates as directors. He claimed to be managing the business on behalf of these directors and earning a modest annual salary.

Investigation

AUSTRAC’s analysis of financial data showed that over a number of years the offender had made several significant cash withdrawals totalling A$1.8 million from ATMs, including an A$650,000 cash withdrawal from ATMs at a casino. He also transferred A$831,000 from business bank accounts into his personal credit card accounts and other non-company bank accounts.

Money Laundering Through Casinos

The investigation was supported by several financial institutions who submitted suspicious transaction reports to AUSTRAC, and helped authorities prove that the offender was using business income from the companies under his control to fund his lifestyle and gambling activity while evading tax.

Case Result

The offender was found guilty of three counts of dishonestly causing a loss and 17 counts of obtaining a financial advantage by deception. He was sentenced to five years and four months’ jail and ordered to pay A$890,112 to the ATO.

Red Flags

Casino Money Laundering Red Flags In America

- Frequent, high-volume ATM cash withdrawals

- Transfer of large cash amounts from business accounts into personal accounts

- Large cash withdrawals at casino ATMs

Conclusion

Whilst money laundering and financial crime represent a serious problem for Australia, authorities are becoming more organised and sophisticated in their investigations, using their knowledge of common red flags, advanced financial intelligence, and leveraging industry partnerships to make it increasingly difficult for offenders to evade detection and prosecution.